What’s the issue?

On Tuesday, a unanimous panel of the U.S. Court of Appeals for the District of Columbia Circuit upheld a lower court decision that ordered the U.S. Army Corps of Engineers (USACE) to prepare an Environmental Impact Statement (EIS) to support its decision to grant DAPL an easement. The lower court has scheduled a status conference for February 10.

Why does it matter?

DAPL shippers, and by extension the market in general, face tremendous uncertainty over the ability to move crude while the EIS is being prepared. If the USACE or the lower court orders DAPL to operate at a reduced pressure or completely shuts down the pipeline while the EIS is prepared, alternative pipeline capacity out of the region will be tested and the cost to move barrels out of North Dakota will increase, since alternatives, such as truck or rail, can be much more costly than pipeline capacity.

What’s our view?

We would not be surprised to hear from the USACE that it will order DAPL to operate at a reduced pressure while the EIS is prepared, but we would be surprised if it actually orders a complete shutdown. Using Arbo™, our liquids network intelligence product, shippers can quickly compare flow assurance and transportation cost options out of North Dakota.

As we wrote in Future of DAPL and MVP Is Up to Biden’s USACE, on Tuesday a unanimous panel of the DC Circuit Court of Appeals upheld a lower court decision that ordered the U.S. Army Corps of Engineers (USACE) to prepare an Environmental Impact Statement (EIS) to support its decision to grant DAPL an easement. As we expected, the lower court then directed the parties to appear on February 10 for a status conference to discuss both the impact of the Court of Appeals decision on the request for an injunction to stop the flow of oil in the pipeline and how the USACE expects to proceed, given the vacating of the easement. While we do not expect that the USACE will order an immediate shutdown of the pipeline, we think shippers should be planning for a pressure reduction, which would reduce the total capacity available, as well as a possible shutdown within 90 days following the February 10 conference. This legal activity and speculation continues to create market shockwaves as one of the primary Bakken crude oil conduits faces an uncertain future.

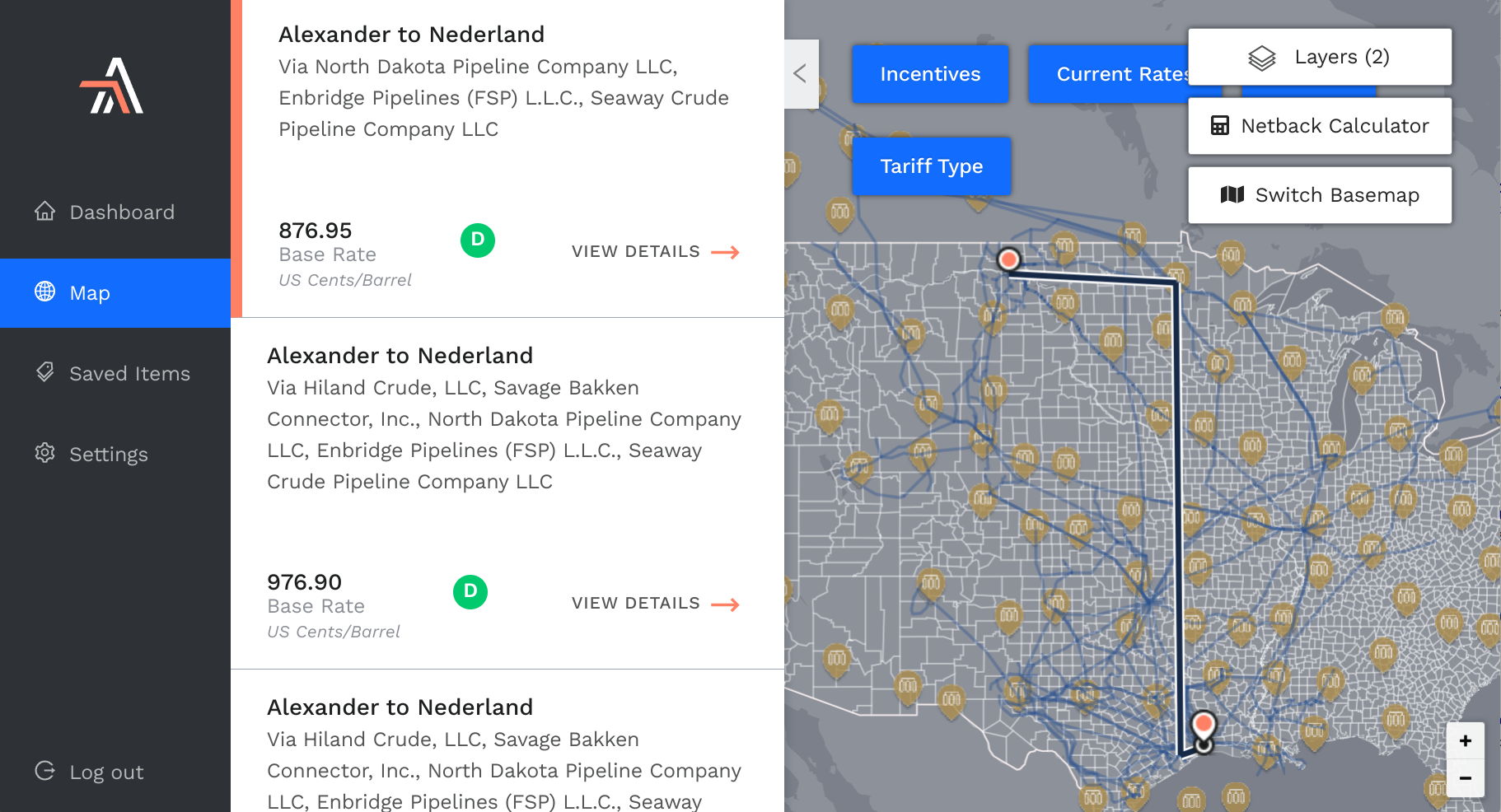

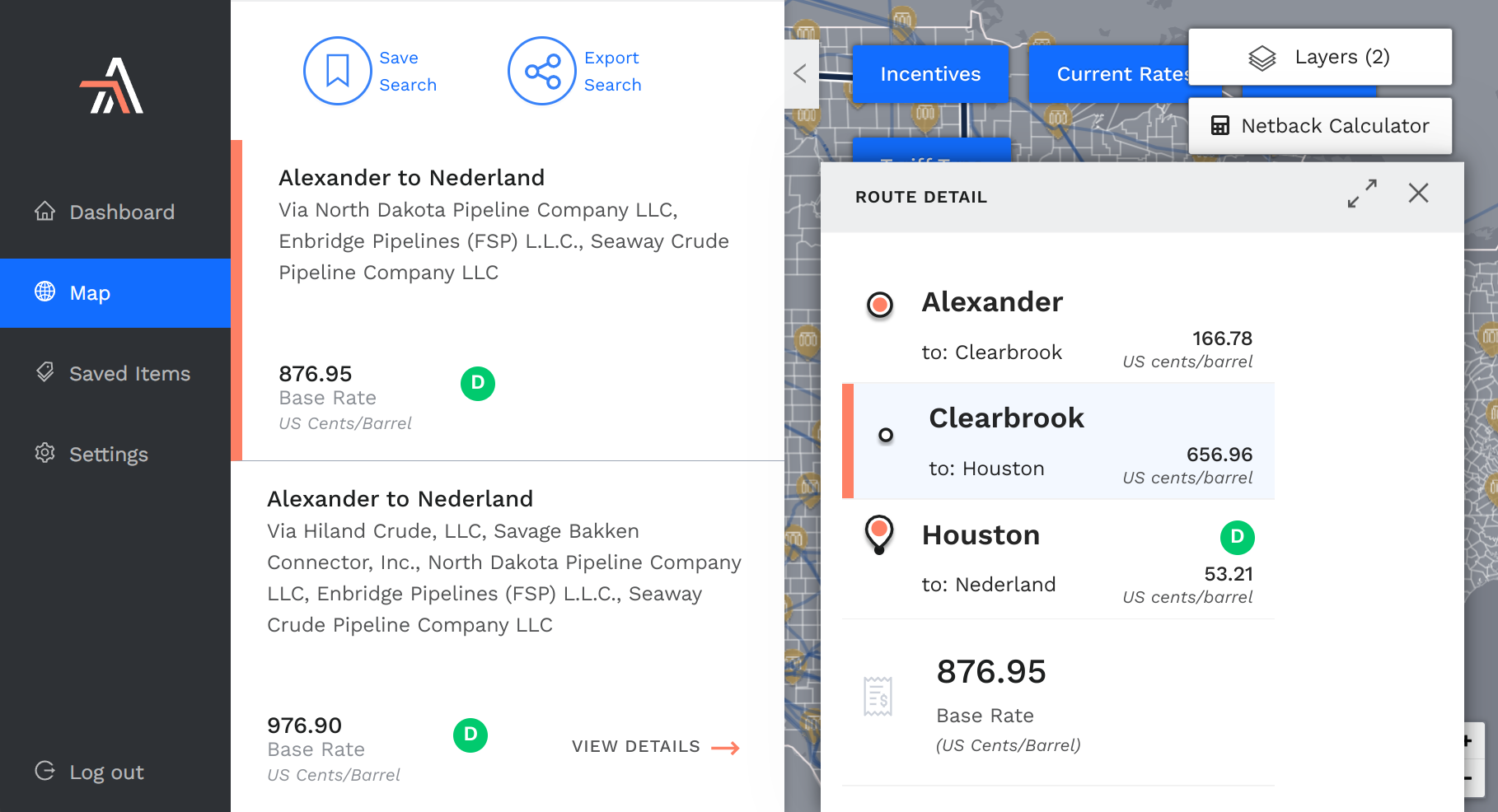

Anyone with an interest in moving Bakken production will need an ability to interpret a complex web of origins, destinations and pipelines to compare rate structures and key rules and regulations, including nomination procedures, shipper requirements, minimum volumes, batching and product specifications. With this information, shippers can assess pipeline alternatives to DAPL while they await a decision from the USACE.

What is at Stake for DAPL Shippers? What are the Contingencies?

If the 570 Mbbl/d DAPL is ordered to operate at a reduced pressure or completely shut down while the EIS is prepared, alternative pipeline capacity out of the region will be tested and the cost to move barrels out of North Dakota will increase, since alternatives, such as truck or rail, can be much more costly than pipeline capacity. If DAPL is ordered to completely shut down, total pipeline takeaway capacity out of the Bakken will get maxed out the moment DAPL goes offline -- including Enbridge’s North Dakota system (355 Mbbl/d), Kinder Morgan’s Double H pipeline (84 Mbbl/d), as well as the True Companies’ pipeline network (260 Mbbl/d). Once these systems are full, every incremental barrel produced will have to be serviced by truck or rail.

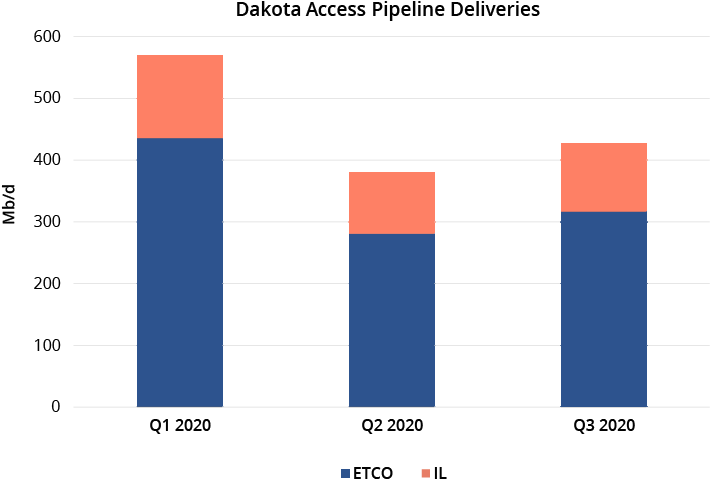

If DAPL shuts down, shippers will likely be willing to move barrels anywhere that will make money to prioritize flow assurance. During 2020, about 75% of the crude oil that was picked up in North Dakota on DAPL flowed through the Energy Transfer Crude Oil Pipeline (ETCO) to the Gulf Coast; the remaining 25% terminated in Illinois to serve Midwest refining markets, as reported to FERC.

For producers and shippers opting for (or forced into) a DAPL alternative, pipeline options for getting barrels to market profitably include: uncommitted rates on alternative pipelines, selling at the lease to marketers or others with existing capacity commitments on the pipelines in hopes of a better deal than paying the uncommitted pipeline rate, or moving barrels by truck or rail.

Using our new Arbo™ platform (in private beta release), shipper options are easy to compare quickly. Below we show the uncommitted rate for the most cost effective DAPL alternative: Enbridge North Dakota/Flanagan South/Seaway pipelines to Nederland via Clearbrook.

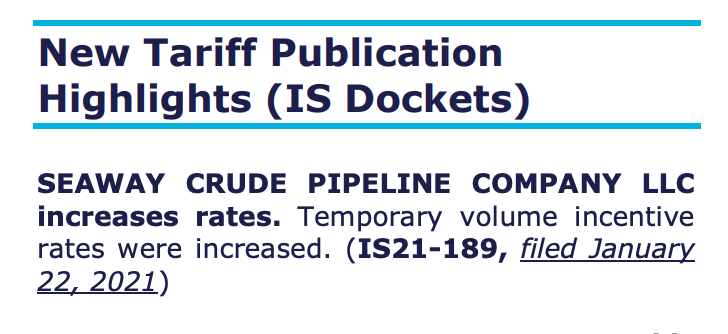

Using Alexander in McKenzie County, ND as a common origin point and Nederland as a destination, options range from $8.76 to $12.04 for walk-up rates but can vary significantly for incentive rates and shipper status. The Seaway Crude Pipeline, which runs from Cushing to Houston and on to Nederland (the final leg for many North Dakota barrels making their way to the Gulf Coast), is a prime example of how much incentive rates can vary from uncommitted base rates, and also demonstrates how often this analysis can change. The current uncommitted rate for Seaway moving light crude from Cushing to Nederland is 300 US cents/Barrel; the temporary volume incentive rate for moving 30,000 barrels per day or more is 45 cents/Barrel. The incentive rates on Seaway have changed twice over the past six months, and are due to increase on February 1, 2021 and March 1, 2021 as future tariffs become effective, making any one month’s costs different from the next.

Subscribers to the Arbo Oil Pipeline Tariff Monitor (OPTM) are able to easily follow these changes.

The OPTM is a biweekly summary of all significant tariff changes, including new and modified tariffs, stations and rate structures, regular and current shipping information for shippers, marketers, traders, and pipeline competitive opportunities.